To all subscribers and friends:

Coffee & Capital Markets will be on hiatus indefinitely as JR Martin transitions into a new role in institutional asset management. Additional information on his new position will be available soon via LinkedIn. Once again, he will be based in Austin, Texas.

For paid subscribers, a pro rata refund will be issued for the balance of your annual subscription. This applies to subscribers who paid by credit card via Substack. For questions, please contact us at jmar@macservices.info.

Finally, we have been publishing weekly market observations since 2008. Over time, the format has evolved. Hopefully, the quality of our material has improved. Since August of ‘21, we have been publishing here on Substack. We have enjoyed the weekly grind — serving our readers with recurring content based on our experience and our network of research contributors.

At some point in the future, we hope to return. Seated comfortably on a patio with a scenic view — or perhaps situated in a romantic coffee shop in some distant locale. Either way, pecking away on our keyboard, sharing observations to help others stay informed and equipped as we explore and ponder the global capital markets together. Until then, best regards...

Observations & Cross-Asset Performance

This week’s briefing is abbreviated, but we offer high-level perspective along with an extra dose of What Others Are Saying.

Following the recent CPI report and the University of Michigan Consumer Confidence Survey, the Fed hiked rates by 75 basis points. As discussed previously, Fed Policy is not equipped to resolve supply-related inflation problems, so the Fed has decided to raise interest rates and tighten financial conditions in an effort to stifle demand. By reducing demand, the Fed hopes to lessen inflationary pressures. Already signs are emerging of a sharp slowdown in the US housing industry — a predictable outcome based on rising mortgage rates. Fed strategy is also aimed at reducing labor demand. This strategy is seems short-sighted and probably entails unintended consequences as discussed previously.

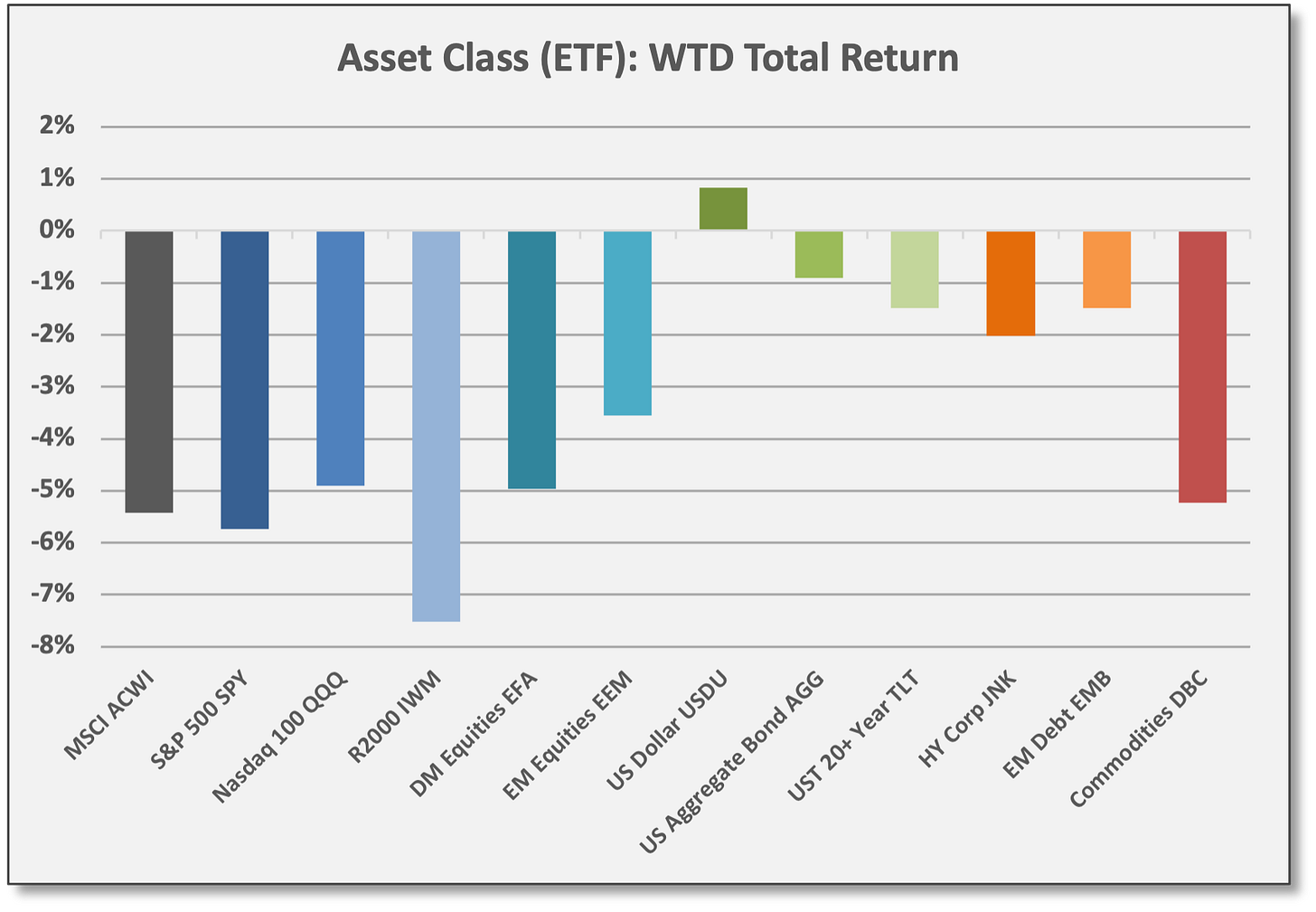

Virtually every major asset class declined last week, except for the US dollar, which posted a modest gain.

All 11 S&P 500 sectors declined last week — along with the four major US size/style segments (large, small, growth, value).

Non-US equities declined, including all major underlying markets.

All major bond sectors declined — both rate-sensitive high-quality and credit-sensitive high-yield, including short maturities and long-duration bonds.

All four commodity sectors declined, including energy. All the major underlying commodities declined as well, except for corn futures.

What Others Are Saying

ClockTower Group, Global Macro & Geopolitics Review, June 2022: “The Fed cannot fix a supply problem. As such, if Fed officials are truly worshiping Volcker and dreaming of deity status decades from now by crushing the current expansion, they are almost certain to end up being panned like the Burns Fed. Why? Because the world needs gargantuan amount of CAPEX to deal with the extraordinary challenges self-imposed by policymakers on a number of different, quite epochal, fronts. From fighting Climate Change to diversifying global supply chains away from China, to ensuring on-shoring for domestic/populist reasons, the world either needs to reverse these policy trajectories (unlikely) or douse the inflationary flame with extraordinary level of CAPEX. The good news is that the CAPEX has been strong thus far. The bad news is that the Fed officials may actually revere Volcker as a God.”

JPMorgan, Flows & Liquidity, 6/15/22: “By quarter-end the potential equity buying we had previously estimated due to rebalancing was around $40 billion due to Norges Bank/GPIF/SNB and an additional amount by US defined benefit pension funds with an upper bound of $167 billion. These numbers look bigger [now] given the equity price declines of June. We now estimate close to $50 billion equity buying due to Norges Bank/GPIF/SNB and an upper bound of $198 billion by US defined benefit plans. Overall, these estimated flows are comparable to last March and well above historical norms.”

FSInsight, First Word, 6/15/22: “No doubt many investors have lost all hope for the economy and markets after the horrific market selling over the past few days. As data from prime brokers show, the magnitude of the selling was capitulatory. After all, only massive liquidations like this take place when investors need to get out, but further downside exists if the current economic and financial conditions lead to a larger economic downturn. While leverage exists today, it is much more in the hands of the public sector (governments) and central banks, and less so for corporates and households. Moreover, while many fret EPS forecasts are too high, corporations earn nominal profits, and thus, elevated inflation is actually supporting nominal EPS. This circles back to the notion of ‘un-killability’ — companies might weather this rise in inflation and even soft landing better than expected — and if so, much of the bad news is discounted today.”

Bespoke, Morning Line-Up, 6/15/22: “PPI data suggests that core PCE will continue to decelerate in May data, and the only real push for an emergency violation of forward guidance has come from CPI, itself driven overwhelmingly by commodity price moves. The Fed has put itself between a rock (underwhelming markets which now fully price 75 bps) and a hard place (violating forward guidance because an inflation indicator that they do not target missed). If the Fed is truly chasing commodity price inflation (as it did to a degree in 2008 and as the ECB did in 2011) the economic outlook should be downgraded significantly. The only way to halt oil and products markets pain is to rebalance global demand for those products lower, and the only way to do that via monetary policy is seriously reducing aggregate demand. We are skeptical the Fed can accomplish that goal without creating a recession, and meanwhile other indicators of inflation pressure ranging from the labor market generally (initial claims) to wages (average hourly earnings) to supply chain stress (PMI data, port traffic, truck rates) have all improved since the May meeting alongside core PCE tracking. That leaves a series of very difficult questions for the Fed to answer about what exactly they’re trying to accomplish and why they are hurting their own credibility by de-linking policy from not only their guidance but also their economic forecast updates.”

JPMorgan, Flows & Liquidity, 6/15/22: “The risk of a policy mistake has naturally increased fears of recession in particular in the US. Web searches with the keyword ‘recession’ have increased sharply surpassing the 2008 high and approaching the March 2020 historical high... In all, there appear to be heightened concerns over recession risk among market participants and economic agents, which could become self-fulfilling if they persist prompting them to change behavior, e.g., by cutting investment or spending.”

Aneta Markowska, Jefferies, 6/16/22: “Housing starts are finally catching up (or down) to demand. The 14.4% m/m May decline puts starts at the lowest level since April 2021... Soaring rents should continue to encourage more multi-family building, but the spike in financing costs may be a deterrent. With 30-year mortgage rates now approaching 6%, there's probably further downside for housing demand and for single-family construction. As of now, residential investment is on track to contract by 22% in Q2, which should knock off a full percentage point from GDP growth. The last time we saw a similar contraction was during the lockdown, and before that in Q3 2010. So housing is already in recession territory, but consumption is still holding up very well and will probably continue to do so, at least through the summer months.”

Aneta Markowska, Jefferies, 6/15/22: “Retail sales came in below consensus but were broadly in line with our forecast... there was a large seasonal hurdle in May, which was hard to beat in light of rising gas prices and spending rotating from good to services... NSA sales ex-autos were actually up an impressive 4.2% m/m. Seasonals knocked off 3.7%, leaving us with a reported increase of 0.5% m/m. So, although today's report was softish, there is no evidence that consumers are throwing in a towel.”

Scott Grannis, Calafia Beach Pundit, 6/11/22: “Federal deficits have plunged, and are likely to remain relatively low and non-threatening for the foreseeable future... If Congress can simply stop spending more, economic growth and inflation will continue to boost federal revenues. Ongoing inflation will also erode the burden of all the federal debt that has been incurred in recent years. Doing nothing and allowing time to pass will go a long way to bailing us out. Unfortunately, there will be a cost to all this, and it will be borne mainly by the middle class as real incomes decline... Meanwhile, the dollar is strong, inflation expectations are subdued, and excess M2 is declining. All of which reinforces the idea there is light at the end of this inflation tunnel. The situation is far from being out of control. Nevertheless, we should expect to see uncomfortably high inflation for another year or so. The huge increase in housing prices in recent years will take at least that long to find its way into Owner's Equivalent Rent [OER], an important component of the CPI, and it will take time for excess M2 to unwind. And meanwhile, supply-chains are still in disarray, and geopolitical tensions are working to boost energy and raw materials prices.”

Christopher Wood, Jefferies, GREED & fear, 6/16/22: “For the record headline CPI inflation rose to 8.6% YoY in May, the highest inflation print since December 1981. The Fed also saw no relief from core data which remains high, with core services inflation continuing to rise... If that was bad enough, Jerome Powell and his colleagues also saw an uncomfortable rise in long-term inflation expectations in the long established and well-respected University of Michigan consumer survey. The median expected inflation for the next five years rose from 3.0% in May to 3.3% in early June, the highest level since June 2008. This matters because it will feed fears of a wage price spiral... Much of this obsession with inflation expectations, particularly market-driven ones, is in GREED & fear’s view academic gobbledygook and only important because the Fed thinks it is important, which is obviously why markets think it is important... Still, in the real world, surveys of actual people, such as the Michigan one, matter more. It is also the case that one-year inflation expectations probably matter most [since] this is more likely to drive pressure for annual wage increases. On this point, the Michigan survey on one-year inflation expectations is sending as worrying a message as the longer term one. The one-year median expected inflation rate rose from 5.3% in May to 5.4% in early June, the highest level since November 1981. Whether this degree of monetary tightening actually happens will depend as much on the politics and the markets as on the economy. For at some point in coming months, amidst bearish price action in markets, the focus of vote-seeking American politicians is likely to switch from worrying about the need to be seen to be doing something about inflation to worrying about the impact of monetary tightening on Americans’ 401k plans and the like. GREED & fear’s guess is that this is most likely to start happening when the S&P 500 has declined by 30% from the peak.”

FSInsight, Technical Strategy, 6/17/22: “US indices are growing closer to meaningful lows, and this involves a combination of bearish sentiment, out-sized selling pressure/downside volume, cycles projecting lows in late June, some outperformance in Growth stocks and some gauges of oversold conditions that are close to levels that marked bottoms back in 2016 and 2018. In the short-run, Friday’s stabilization might lead to some brief follow-through into next Tuesday. However, after 10 of 11 weeks lower (which has not been seen in 50 years) it’s going to be imperative to start making higher highs and higher lows. While overly simplistic, the rally attempts in recent weeks have not proven nearly strong enough to break downtrends, but outside of price, there remain credible reasons to expect an end to this selling is right around the corner. Look to buy dips at 3505-3600 into end of month.”

TS Lombard, Asset Allocation, June 2022: “The Fed has chosen price stability over full employment. At the June meeting, Powell implied that the Fed is prepared to pay the ultimate cost — a recession — to bring inflation under control: There can be no full employment in the long run unless there is price stability. This means that financial conditions will become increasingly restrictive. And tighter financial conditions will continue to weigh on asset prices. We are not yet ready to buy the dip in equities — for at least five reasons: (1) The equity decline so far is small for a bear market, especially if a recession is coming; (2) Valuations remain above average in the US, far from capitulation levels; (3) Earnings growth expectations are still exceptionally optimistic; (4) The Fed is showing no intention of pivoting to a more dovish stance anytime soon; and (5) Bond yields will continue to increase until the end of the tightening cycle is in sight. We maintain our defensive stance this month as downside risks to growth keep mounting. We stay underweight both equities and bonds this month — although we think that the risk/reward is slightly less unappealing in Fixed Income.”

Michael Hartnett, BofA Securities, The Flow Show, 6/16/22: “Inflation shock (started H2’21)... Rates shock (H1’22)... Recession shock (H2’22) plus crash (not quite done yet)... Once all done and dusted in H2, opportunity knocks; we say at SPX 3600 nibble, at 3300 bite, at 3000 gorge.”

Marko Kolanovic, JPMorgan, Global Markets Strategy, 6/15/22: “We stay pro-risk and make no major changes to our model portfolio this month, holding OWs in equities and commodities funded by UWs in bonds and cash... The move in markets prices in more than enough recession risk, and we believe a near-term recession will ultimately be avoided thanks to consumer strength, COVID reopening/recovery, and policy stimulus in China. We also see strong supports from low investor positioning, depressed sentiment, and corporate buyback inflows. While we expect markets to recover YTD losses in H2 to finish roughly flat, we don’t advocate indiscriminate buying of broad risk markets. We keep a large overweight in commodities both at an asset class level and in equity sectors and currencies, given our super-cycle thesis and to hedge inflation and geopolitical risks. We remain underweight credit vs. equities given the greater vulnerability of the former to higher interest rates and QT. Within equities we favor segments that sold off strongly and are trading near record low relative valuations (e.g., innovation, China, small-caps, biotech, etc.), while underweighting crowded/expensive segments such as defensives.”

Morgan Stanley, Cross-Asset Playbook, 6/17/22: “We think this continues to be a ‘normal’ cycle, accelerated. Late-cycle dynamics drive above-average recession risk... Peaking inflation and falling PMIs over the next six months should mean a transition in market focus to growth/EPS. Large divergences in growth, inflation, and policy persist across the US, EU, China, Japan, and Emerging Markets. Late-cycle risks keep our positioning light, with commodities our only OW. Low systemic risk and macro divergences support more relative value in a portfolio... It’s a better environment for cross-asset alpha than beta.” Note: MS quantitative research team favors the following: (1) Japan > US equities, (2) US small-cap > US large-cap, (3) UST yield-curve flatteners versus UK curve steepeners, (4) oil > metals, (5) MBS > IG corporate bonds > HY corporates. UST curve flatteners imply short positions in short-term bonds as and long positions in longer-duration bonds as rates converge on a relative basis.

FSInsight, Signal From Noise, 6/16/22: “Energy is a cyclical industry, where losses in bad years are recouped in good years. The industry has been by far the worst performing sector over the past decade, despite a doubling in production. It has long been an under-invested area because of poor past returns (blowoff tops in 2008, 2014 and 2020) and ESG concerns, as well as divestment initiatives, restrictive access to bank lending, and combative Energy policy decisions... But from China to India to Africa, billions of humans need oil for almost everything — no matter how many people are driving a Tesla next year… The pandemic killed demand for oil and gas, leaving the world vulnerable to Putin’s supply-side punch. As Russian energy disappears from the market, prices are expected to continue surging until the global economy slows down enough to reduce demand. At its core, our Energy thesis is rooted in supply and demand: A lack of supply is coinciding with a structural shift in demand. Capital expenditure was already low before COVID-19, and it has plummeted further in recent months as producers prioritized maintaining existing operations… We believe persistent demand growth in the next few years, slowed production growth from global super-majors, and the exhaustion of OPEC’s spare capacity are all tailwinds for Energy stocks... And despite the recent pullback — signifying the area might be over-extended in the short-term — we believe the long-term set-up remains strong... Consider that during 2020, when the entire world shut down — almost nobody was flying or driving — the world still consumed more than 70 million barrels of oil per day. This underscores the global demand for oil and gas. Necessary shifts to renewables and sustainable Energy doesn’t negate the need for oil, which is critical for everything from global transportation to goods production to heating homes.”

ExxonMobil, 6/15/22: “We have been in regular contact with the administration to update the President and his staff on how ExxonMobil has been investing more than any other company to develop US oil and gas supplies. This includes investments in the US of more than $50 billion over the past five years, resulting in an almost 50% increase in our US production of oil during this period. Globally, we’ve invested double what we’ve earned over the past five years — $118 billion on new oil and gas supplies compared to net income of $55 billion. This is a reflection of the company’s long-term growth strategy, and our commitment to continuously invest to meet society’s demand for our products. Specific to refining capacity in the US, we’ve been investing through the downturn to increase refining capacity… We kept investing even during the pandemic, when we lost more than $20 billion and had to borrow more than $30 billion to maintain investment to increase capacity to be ready for post-pandemic demand.”